IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

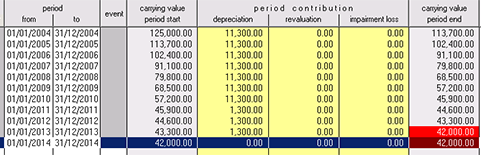

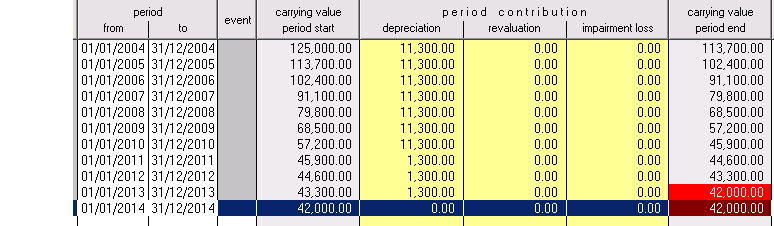

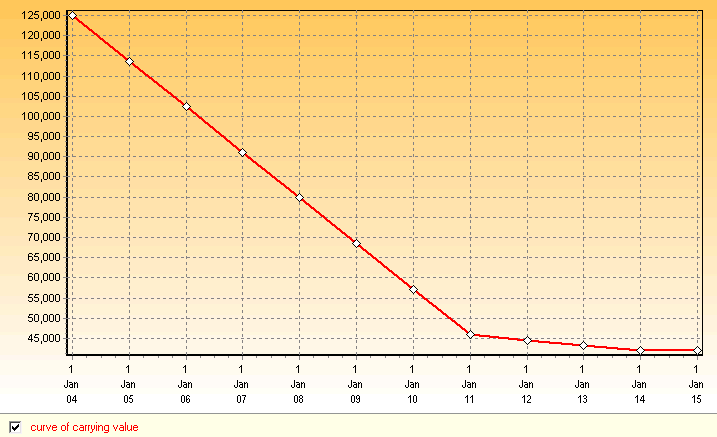

Asset with increase in residual value

Background: Saltcake Ltd operate a car ferry in the Scottish islands. Their ferry was purchased second-hand on 1 January 2004 for £125,000 and at the time was estimated to have an economic life of 10 years and a residual value of £12,000. At 31st December 2010, because of a surge in the price of steel it comes to light that the scrap value of the vessel is £42,000. Management continue operating the ferry. The company's year-end is 31st December.

Objective: To show how the asset will be accounted for under IAS 16 in the company's annual accounts from 31st Dec 2004 to 31st Dec 2014.

From the date upon which the new residual value is known the depreciation is calculated so as to write down the excess of the carrying amount over the residual value over the remaining life.