IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

Asset with increase in estimated useful life and reintegrated depreciation

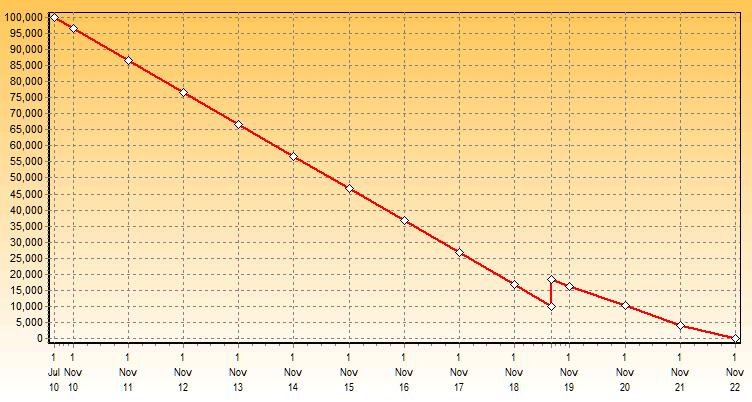

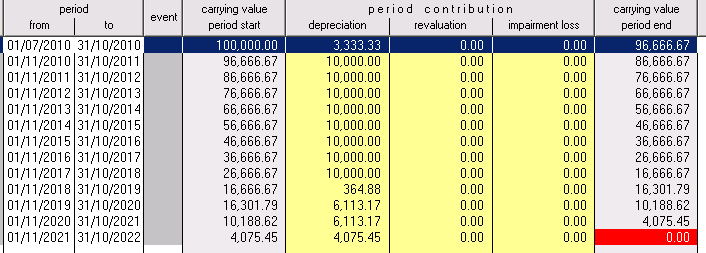

Background: Gravelex Ltd on 1st July 2010 purchases for £100,000 a piece of land destined for gravel extraction and begins work on the same day. The extent of the quarry has been assessed and the company has set up an infrastructure which will allow mining of the gravel at a constant rate for ten years. The company's year-end is 31st October.

Survey carried out 1 July 2019: Nine years after the purchase a precise survey is made and it is discovered that, despite having been worked as planned, the quarry is only 75% exhausted. This is because the water content of the gravel was much higher than initially projected leading to shipment tonnages as planned but lower depletion of the quarry. Management consider that too much depreciation has been applied.

Objective: To show how the asset will be accounted for under IAS 16 in the company's annual accounts from 31st Oct 20010 to 31st Oct 2022.

Under paragraph 51 of IAS16 the useful life and residual value needs to be reviewed at least each year and if expectations differ from previous estimates the change is accounted for as a 'change in accounting estimate under IAS 8.

Thus the carrying amount of the asset has been adjusted to reflect the fact that at 1 July 2019, 25% of the useful life of the asset is estimated to remain.