IFRS asset accounting

examples

- Asset with a change in economic life, impairment loss, revaluation

- Asset with increase in estimated useful life

- Asset with decrease in estimated useful life

- Asset subject to impairment

- Asset with reversal of impairment

- Asset with revaluation

- Asset with reversal of revaluation

- Asset with increase in residual value

- Asset with decrease in residual value

- Asset with increase in estimated useful life and reintegrated depreciation

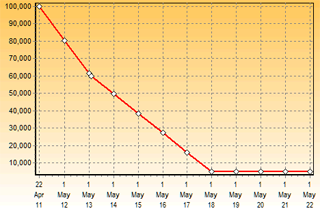

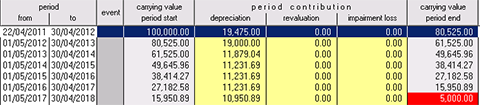

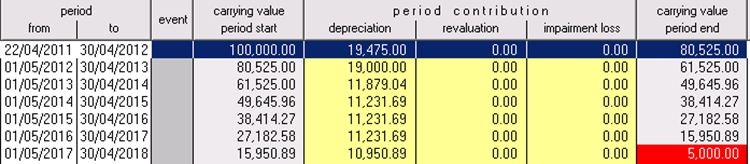

Asset with increase in estimated useful life

Background: Burlington Books provides accounting services and operates a number of accounting offices using PC's to carry out the work. Their year end is 31st May. They replace their PC's about every five years and on 22 April 2011 install new equipment for a value of £100,000. This is estimated to have a residual value of £5,000 after five years.

Change in useful life: The management discuss the frequency of updating computer systems having observed that the current PC's are largely capable of handling future storage and computational needs. From 1st June 2013 they decide to extend the economic life used in their depreciation model to 7 years.

Objective: To show how the asset will be accounted for under IAS 16 in the company's year-end accounts from 31st May 2011 to 31st May 2019.

The carrying value of the asset will decrease on a shallower incline from the effective date of the change in estimate of useful life.

This change in accounting estimate does not require the same treatment as a change in accounting policy or the correction of a prior period error which may require retrospective restatement (see IAS 8).

This is a simple example where, following the change in the view of the useful life, the depreciation is adjusted so as to reach the residual value at the appropriate date.